At the end of my City Talk column today in the Savannah Morning News, I make a number of comments about the slow but steady housing recovery.

Calculated Risk aggregates national housing data better than any site that I know, so I just want to make a few observations with links to various posts regarding prices, new construction, and the ongoing dangers of large amounts of shadow inventory coming on to the market.

I talk a good bit about shadow inventory today, but we’re seeing signs in some cities that the problem might be healing itself better than many expected. Check out CR’s San Diego: “Fears recede of second crash from ‘shadow inventory”. We here in Savannah might be behind the curve of a city like San Diego that got slammed early on, but the number of defaults is declining and banks are being more expeditious in selling foreclosures.

Check out this post to see how the number of short sales has increased in hard hit markets while the number of foreclosures has decreased. That’s despite the incredibly cumbersome short sale process.

For example, in Las Vegas the total distressed share of the market fell to 60.7% in July 2012 from 70.4% in July 2011. That’s still an absolutely horrible number, but it’s clear movement in the right direction. In July 2011, 50.2% of sales were foreclosures and 20.2% were short sales; in July 2012, 20.7% of the sales in Las Vegas were foreclosures and 40.0% were short sales.

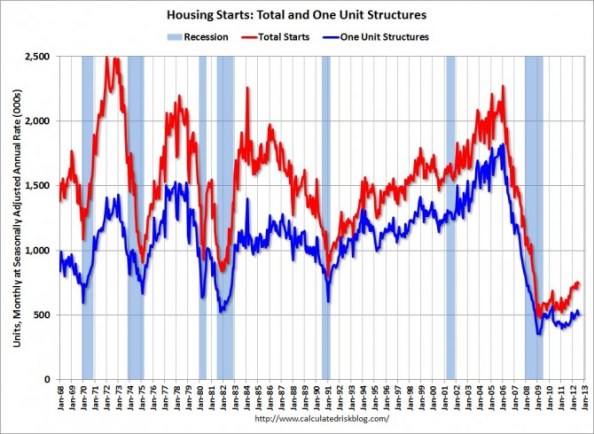

And here come a couple of graphs from Calculated Risk’s galleries:

Housing starts remain near their historical lows, but they appear to have bottomed, both for single-family and multi-unit structures:

The deep decline in housing starts and the slow recovery in that number are key reasons for the sluggish economic recovery overall. There’s very little that anyone could have done to make the housing recovery significantly faster.

Nationally, home prices are back close to a predictable trend line including adjustments for inflation:

I think we’ll continue to see some price declines here in Savannah, but I think they will be relatively small and limited to certain areas and certain price points.