A few days ago on the Newshour, in response to a question from Ray Suarez about the debt and deficit, Wisconsin Governor Scott Walker said:

A few days ago on the Newshour, in response to a question from Ray Suarez about the debt and deficit, Wisconsin Governor Scott Walker said:

Well, my hope is, if we pursue that, we ultimately have some long-term structural changes, so that we are not revisiting this just a couple years down the road.

Again, many of our states, Democrat, Republican governors alike, can make long-term structural changes, so that we are really thinking less about the next election and more about the next generation.

But the other part is, we want to make sure we do it in a way that helps the economy. The biggest single thing — and [Gov. Jack Markell of Delaware] and I were on a panel a couple weeks ago at the U.S. Chamber of Commerce. And we hear it repeatedly in each of our states and across the country on a national basis. The biggest single thing of standing in the way of employers, big and small and everyone in between, adding more jobs, is uncertainty.

It’s a common sentiment, and the attendees at that Chamber of Commerce panel may have even believed that uncertainty is the biggest factor preventing job creation.

But it’s wrong. It’s not true.

The biggest reason employment remains weak is very simple: lack of customers.

There might be some larger corporations that are reluctant to hire for reasons related to medium-term uncertainty about the debt or about health care costs down the road, but small and medium-sized businesses aren’t going to turn away customers because of lack of staffing. If they have enough demand for products and services to warrant additional employees, they will hire them.

Note this graph from Calculated Risk:

Here’s Calculated Risk’s accompanying commentary:

Weak sales is still the top business problem with 24 percent of the owners reporting that weak sales continued to be their top business problem in June.

In good times, owners usually report taxes and regulation as their biggest problems.

David Leonhardt covers some of this ground in the NYT today:

There is no shortage of explanations for the economy’s maddening inability to leave behind the Great Recession and start adding large numbers of jobs: The deficit is too big. The stimulus was flawed. China is overtaking us. Businesses are overregulated. Wall Street is underregulated.

But the real culprit — or at least the main one — has been hiding in plain sight. We are living through a tremendous bust. It isn’t simply a housing bust. It’s a fizzling of the great consumer bubble that was decades in the making.

The auto industry is on pace to sell 28 percent fewer new vehicles this year than it did 10 years ago — and 10 years ago was 2001, when the country was in recession. Sales of ovens and stoves are on pace to be at their lowest level since 1992. Home sales over the past year have fallen back to their lowest point since the crisis began. And big-ticket items are hardly the only problem.

The Federal Reserve Bank of New York recently published a jarring report on what it calls discretionary service spending, a category that excludes housing, food and health care and includes restaurant meals, entertainment, education and even insurance. Going back decades, such spending had never fallen more than 3 percent per capita in a recession. In this slump, it is down almost 7 percent, and still has not really begun to recover.

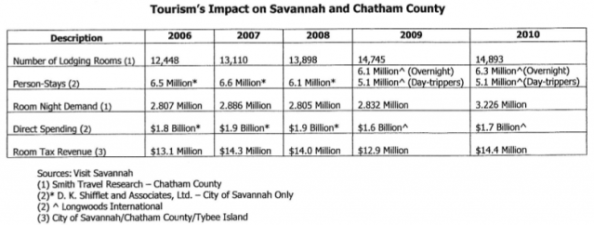

Here in Savannah, take a look at some of the data just released regarding spending by visitors:

I hesitate to draw too many conclusions given that these studies were done by different consultants, covered different geographies, and looked at varying categories. Still, note how direct visitor spending stagnated during the recession. At $1.7 billion, it’s still 10% below the peak. Adjusted for inflation, direct spending by visitors is off about 15% from its peak in terms of real dollars.

For businesses downtown that rely on tourists, that’s a big deal — and a key reason that retail continues to struggle in some areas of the city. Remember also that the number of downtown residents has declined over the last decade. And that the office vacancy rate has increased downtown. With less spending by visitors, residents, and downtown workers . . . well, you get the drift.

This dearth of customers is at the heart of concerns expressed in today’s Savannah Morning News about the possibility of food trucks (mobile food units) in downtown Savannah. That’s a subject I’ll return to soon, either here or in an upcoming column.

In sum, we need cut some of the absurd political rhetoric and to design policies around the key problem facing our consumer-based economy: the lack of demand.

1 comment for “Lack of demand — not uncertainty over debt — is biggest obstacle to economic recovery”